French IT Service Companies Market: 2023 Overview and 2024 Perspectives

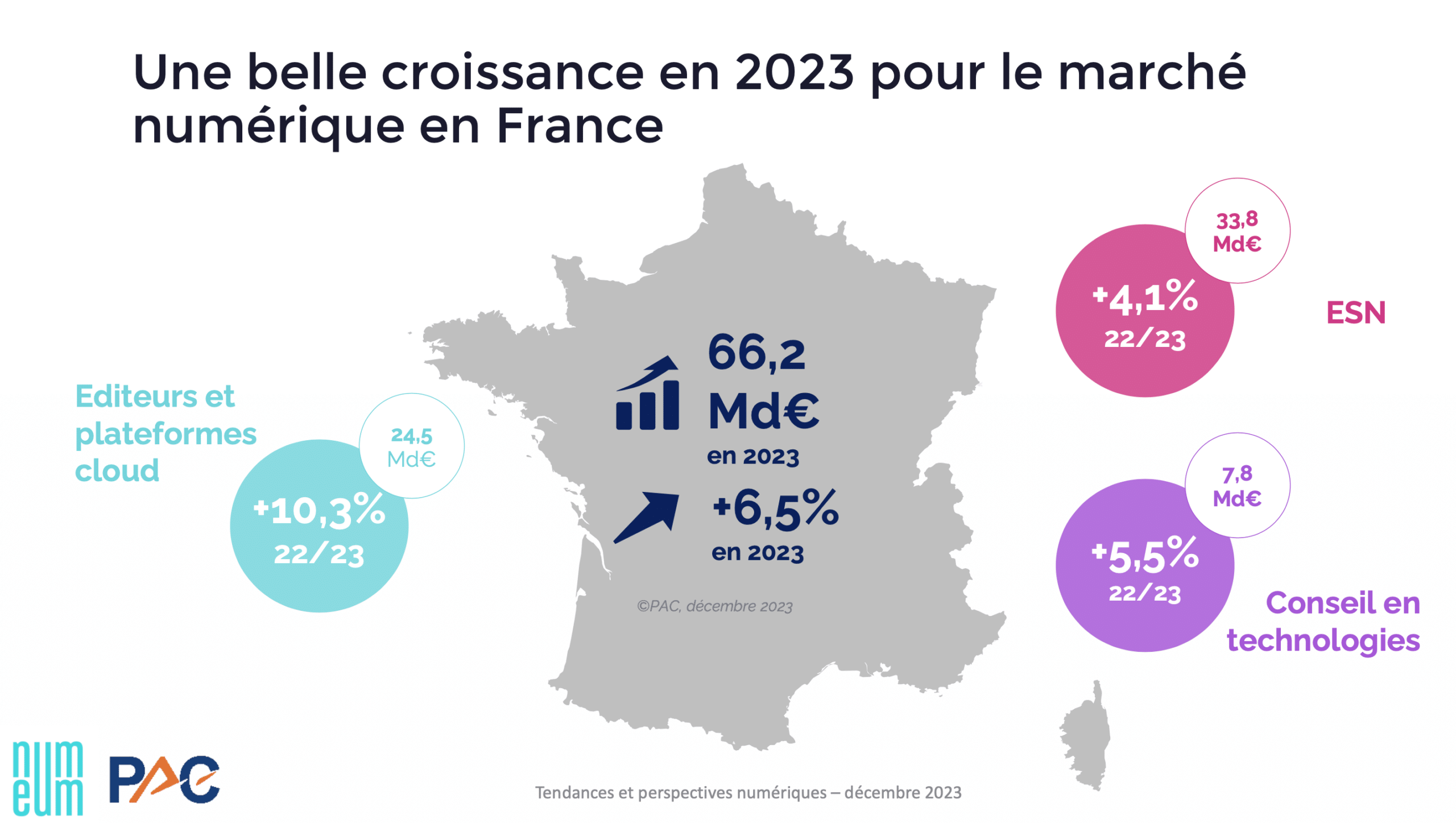

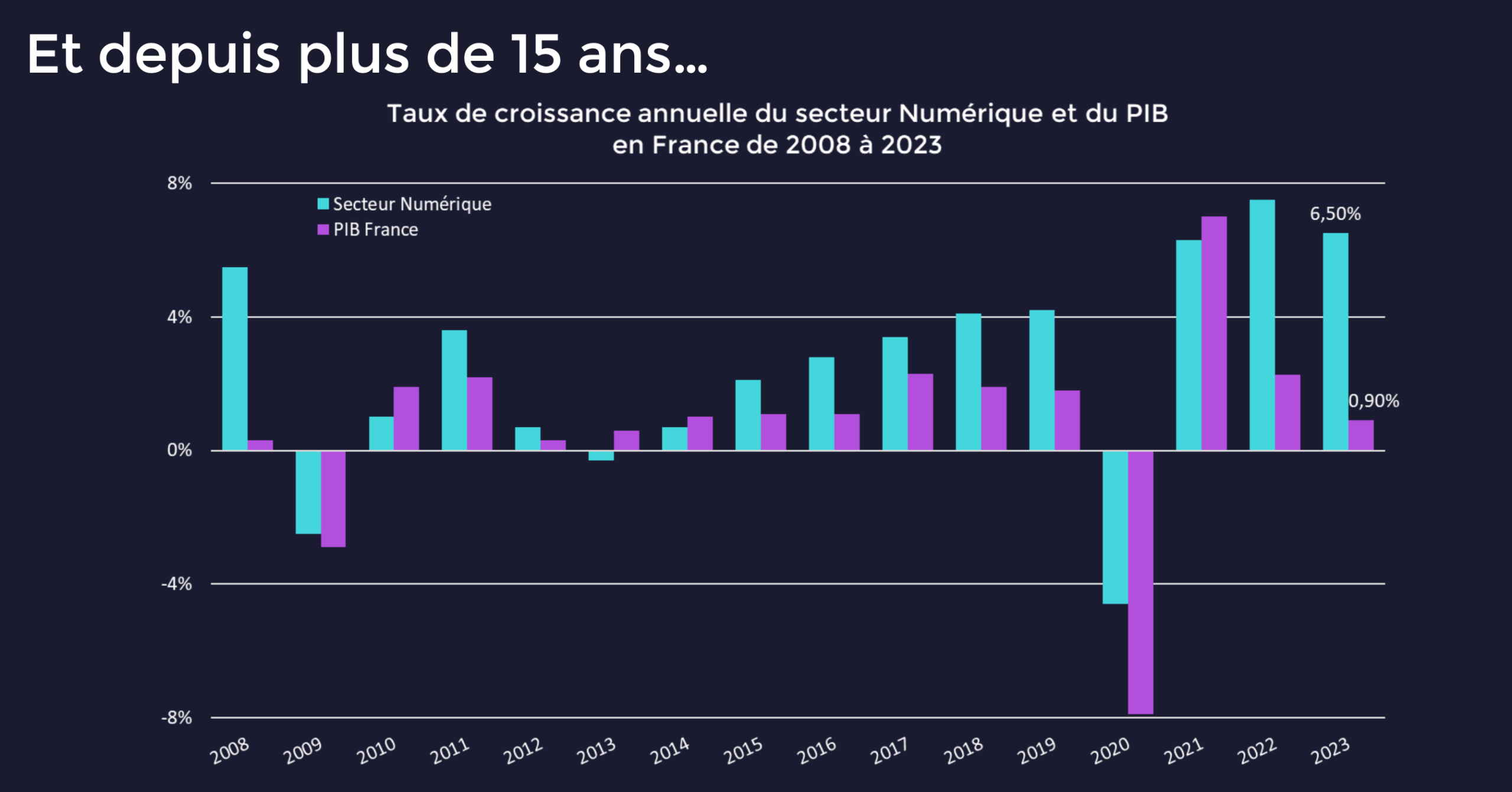

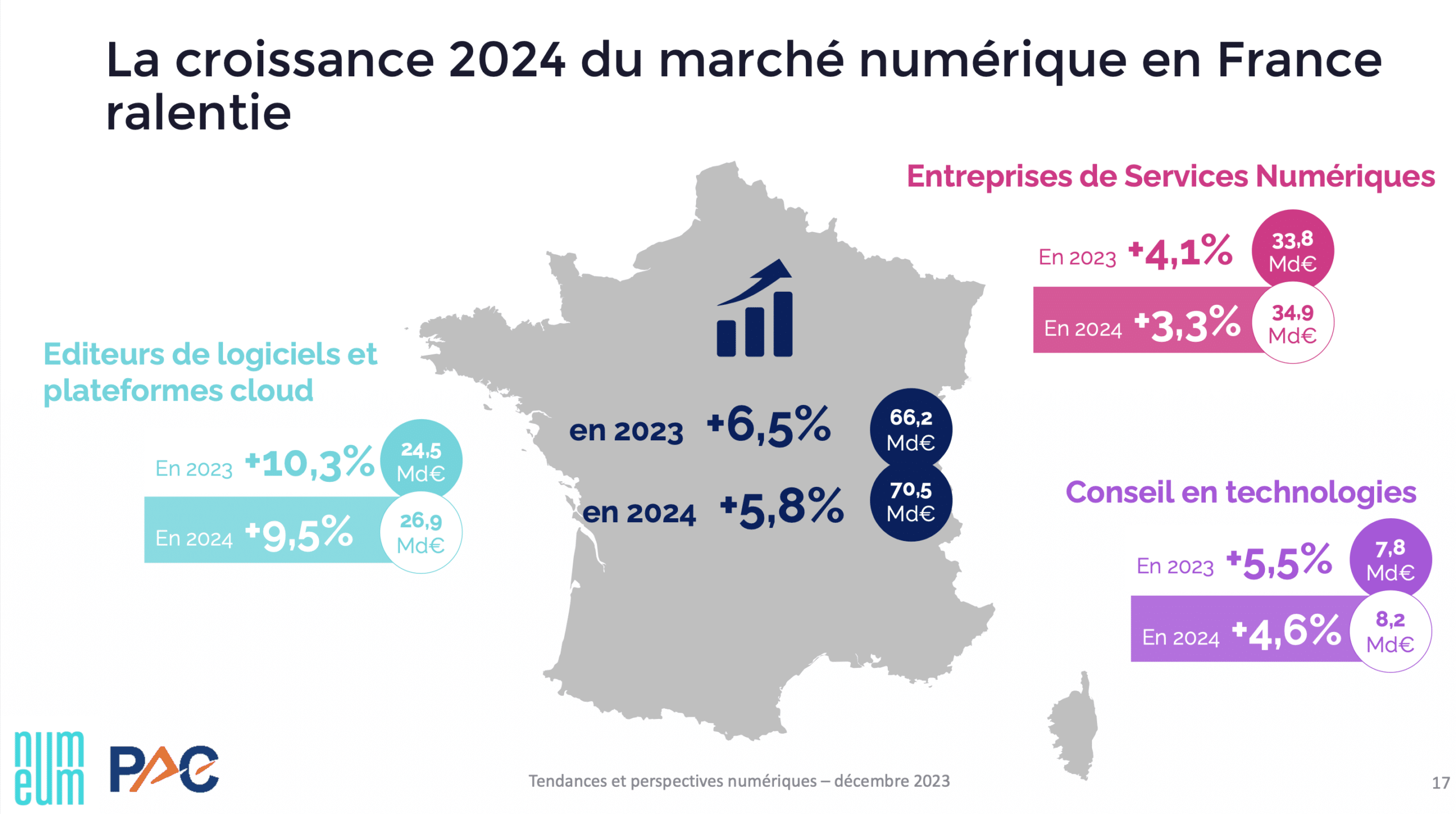

The market for IT service companies and digital technology in France continues to exhibit sustained growth for the entire sector, with an overall increase of +6.5% for the year 2023, surpassing a total size of €66 billion.

The year 2024 is expected to mark a slight deceleration in growth but will remain dynamic with an anticipated +5.8%.

The 2023 market for IT service companies in France

All sectors demonstrate robust growth, as seen in the French IT service companies market in 2022:

- +10.3% for Editors and Cloud Platforms

- +5.5% for Information and Communication Technology (ICT) consulting activities

- +4.1% for IT Service Companies

This dynamism is driven by:

- Cloud Consulting and System Integration (C&SI): the largest sector, exhibiting +17.5% growth in 2023

- Big Data: + 18%

- Security: +10.2%, thanks to increased investments and outsourcing in response to heightened risks

- AI services: a market worth €1.1 billion, experiencing strong growth at +22.9% compared to 2023

- Responsible digital services: the smallest segment (€0.7 billion) but the most dynamic at +39.3%.

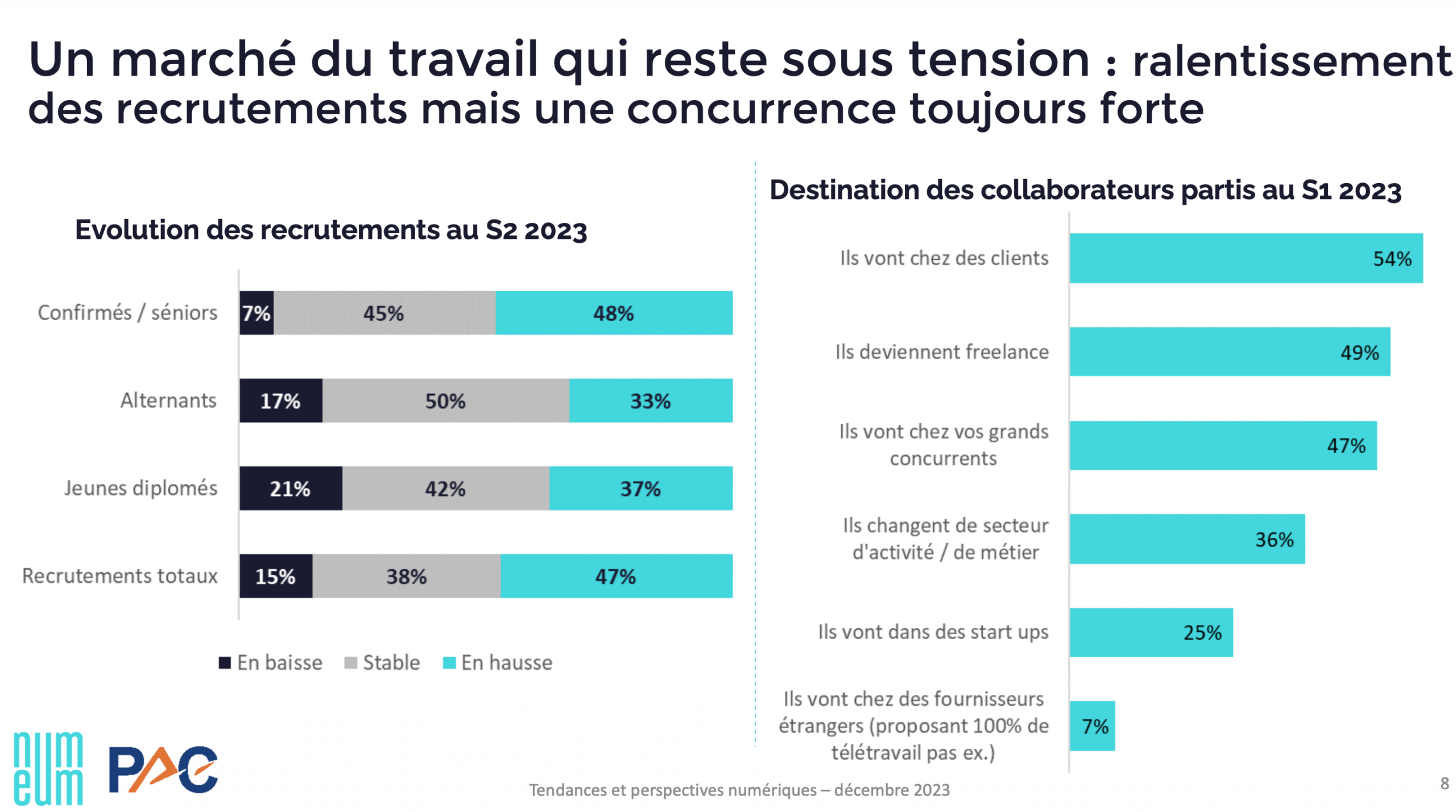

The digital sector continues to recruit vigorously, though slightly less than in the record-breaking year of 2022 (47,000 net job creations).

Furthermore, startups also show positive dynamics: +23,000 net job creations recorded in the startup employment barometer created in January by Numeum. Particularly, the GreenTech, Transport Tech, and Fintech sectors are leading in recruitment.

Recruitment remains challenging due to a shortage of individuals trained in digital skills, intense competition in the job market, and pressure on salaries.

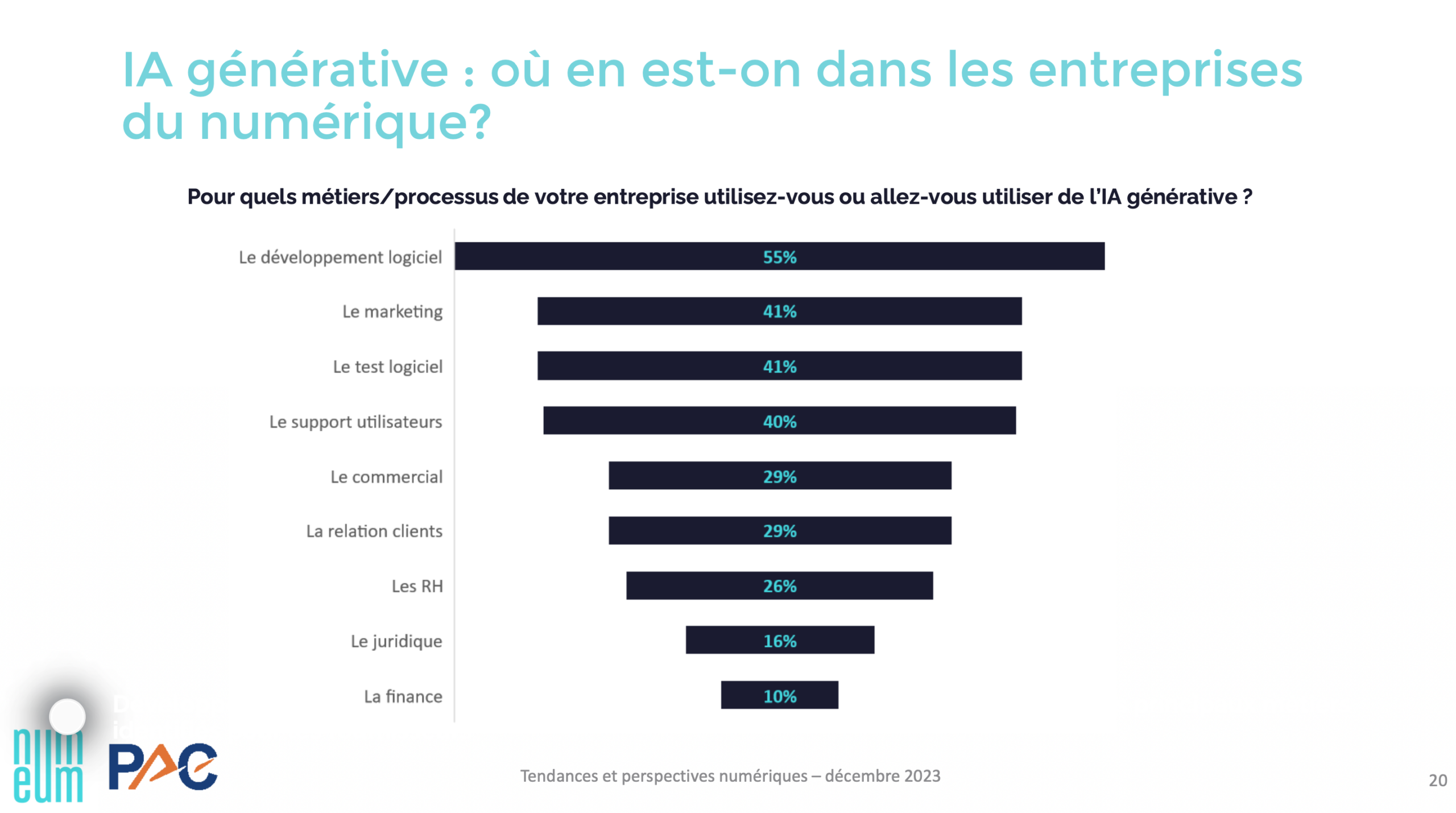

Digital companies see generative AI as a real improvement opportunity for themselves and as a business development opportunity for their clients.

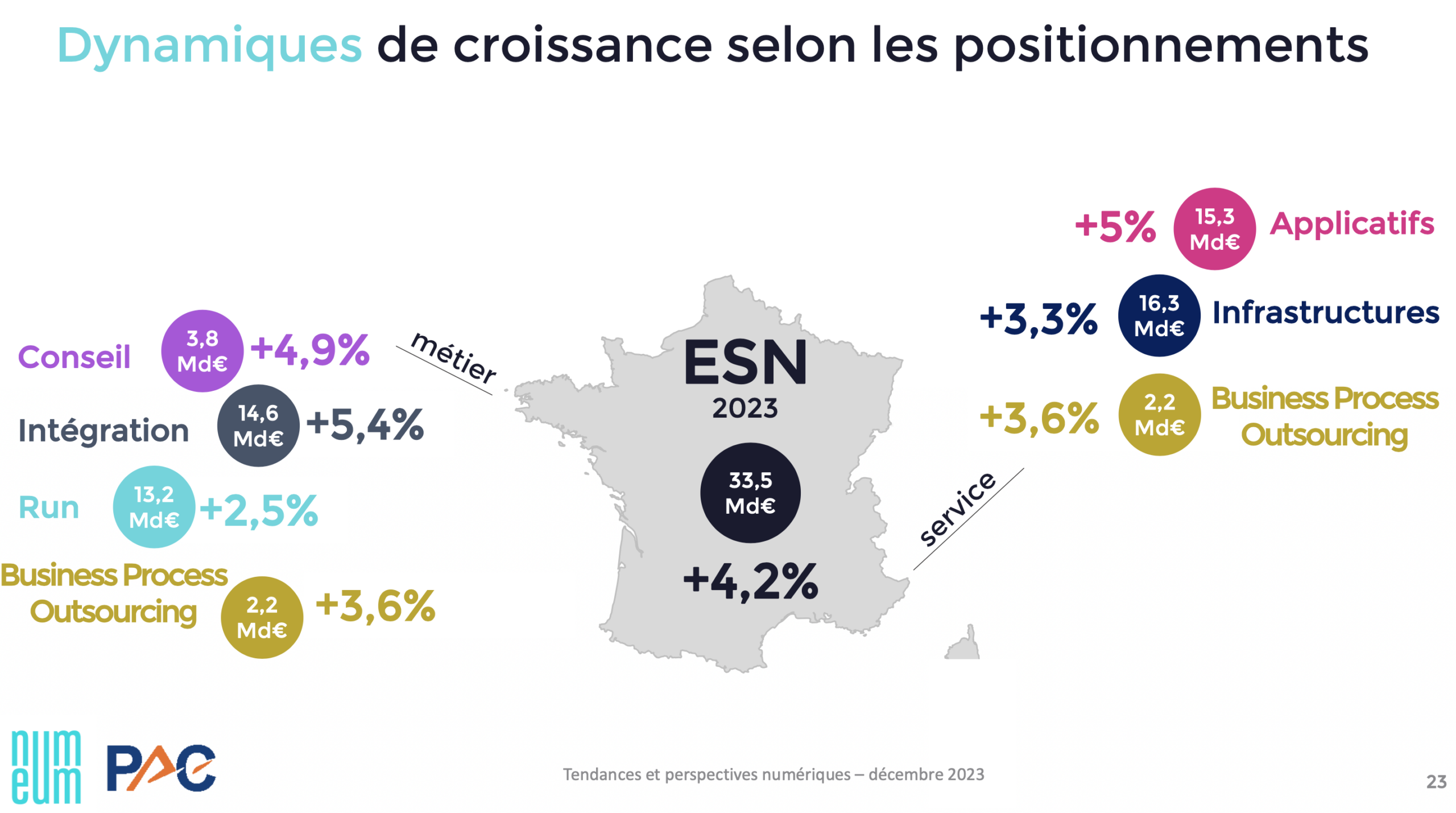

The IT service companies market in France, according to positions:

By professions:

- Consulting: +4.9% with a market worth €3.8 billion

- Integration: +5.4% with a market worth €14.6 billion

- Run: +2.5% with a market worth €13.2 billion

- Business Process Outsourcing: +3.6% with a market worth €2.2 billion

By services:

- Applications: +5% with a market worth €15.3 billion

- Infrastructures: +3.3% with a market worth €16.3 billion

- Business Process Outsourcing: +3.6% with a market worth €2.2 billion

2024 perspectives for the French market

2024 is expected to be another year of growth for the sector, with an estimated +5.8% and a market projected to reach €70 billion next year. Generative AI and responsible digital practices will be key development drivers for the year.

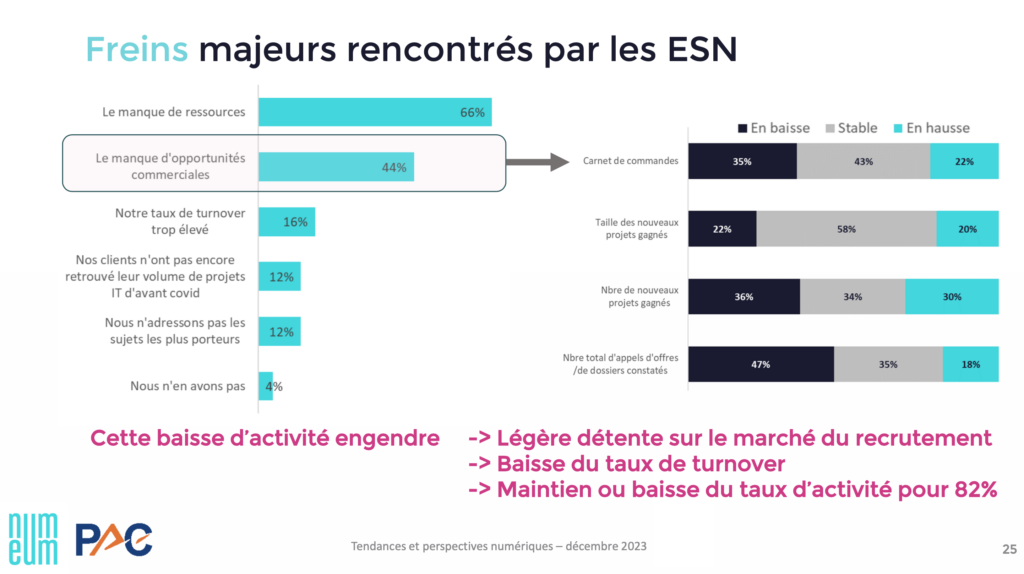

Major obstacles encountered by the IT service companies market in France:

The lack of resources and commercial opportunities are the main hindrances for IT service companies, followed by a too high turnover rate and clients who have not yet regained their pre-COVID activity volume.

This decline in activity leads to a slight relaxation in the recruitment market, a decrease in turnover rates, and a maintenance or decrease in activity rates for 82%.

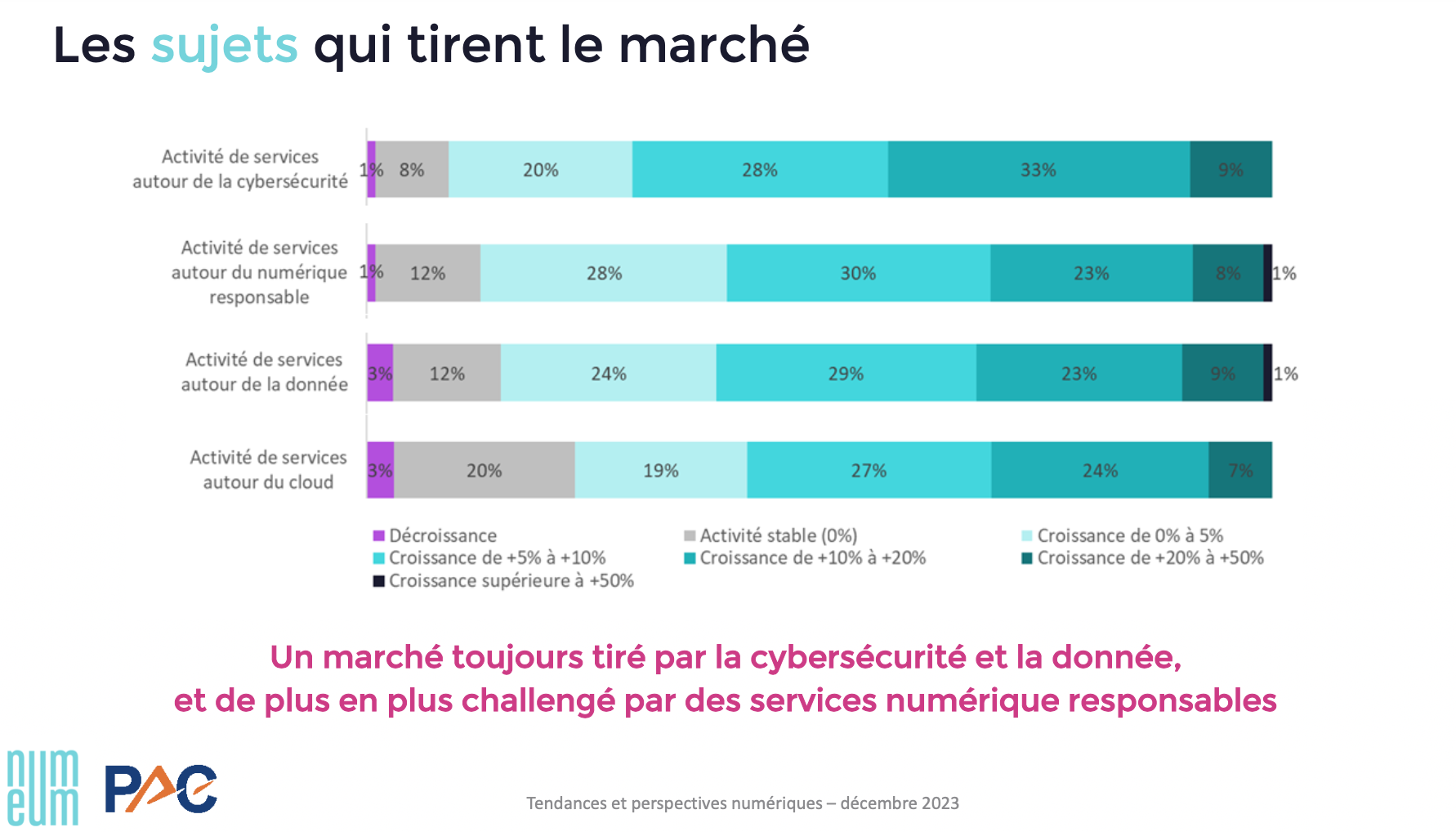

Trends driving the French IT service companies market:

A market still driven by cybersecurity and data, increasingly challenged by responsible digital services.

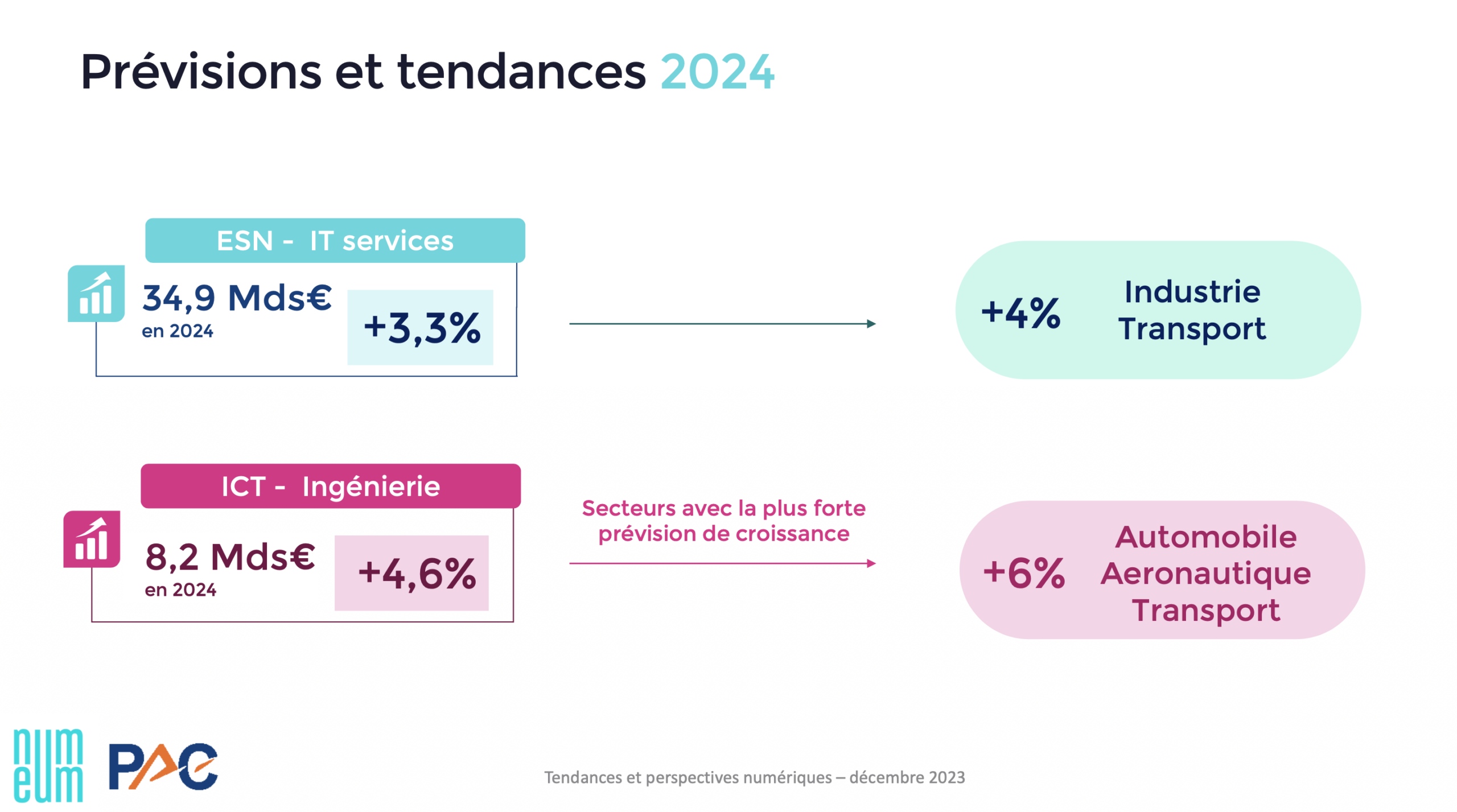

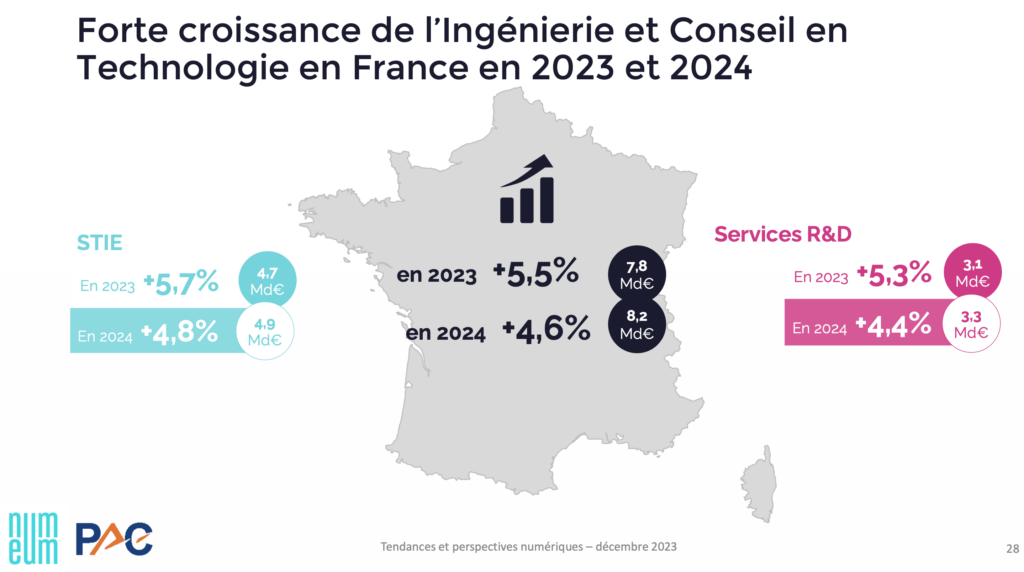

In the IT service companies market, there is significant growth in Engineering and Technology Consulting in France in 2023 and 2024. This represents a market of €7.8 billion in 2023 (+5.5%) and is estimated at €8.2 billion for 2024 (+4.6%).

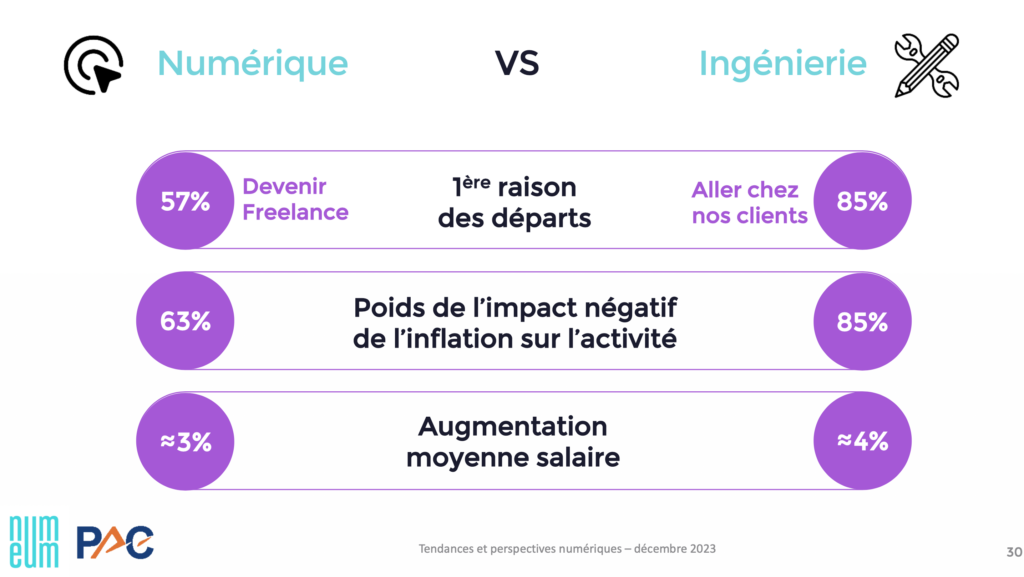

However, IT service companies and engineering firms do not face the same staffing challenges. The reasons for employee departures vary, with 57% choosing to become freelancers on the IT service company side and 85% joining clients on the engineering side.

Interesting trends are observed for 2024. IT service companies anticipate that the sector with the highest growth will be in industry and transport (+4%), while ICTs estimate it will be in automotive and aerospace (+6%).