Numeum’s Biannual Market Barometer for IT service companies and ICTs

Numeum, the leading union of IT service companies in France, reveals the results of their biannual survey conducted with the research firm PAC.

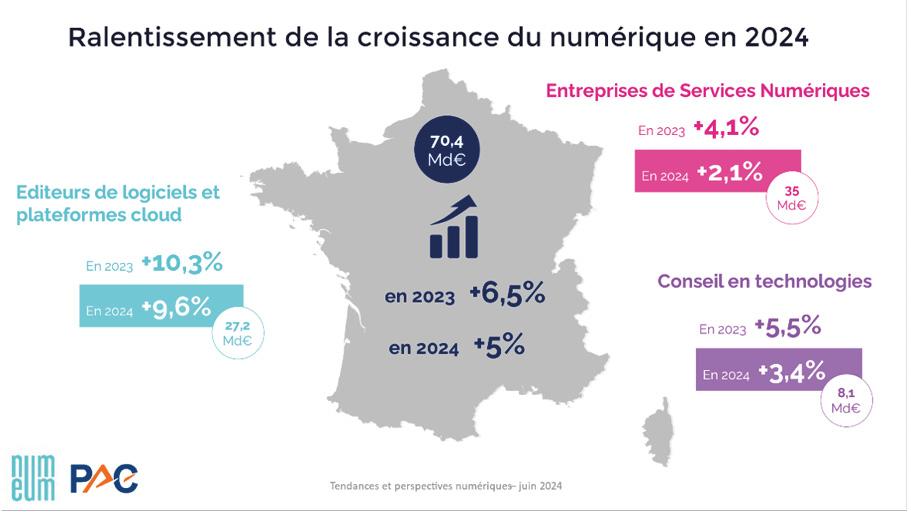

While in December last year, the growth of the digital sector for the upcoming year was estimated at +5.8%, the estimates have been revised downwards, particularly for IT service companies: now, a +5% growth is expected for the entire sector in 2024.

Innovation, Resilience, and Sustainable Growth: The Key Words for the Digital Sector in 2024

After a +6.5% growth in 2023, the digital market is expected to grow by +5% in 2024, confirming its key role in the French economy despite a slowdown in orders and a cautious market context.

All professions will face a slowdown in their revenue growth:

- Estimated growth for Software Publishers and Cloud Platforms in 2024: +9.6%

- Estimated growth for IT Service Companies (ESN in French) in 2024: +2.1%

- Estimated growth for Technology Consulting activities (ICT) in 2024: +3.4%

In 2024, the size of the digital market is thus estimated at 70.4 billion euros:

- 38.7% of the market for software publishers with 27.2 billion euros in revenue

- 49.8% of the market for IT service companies with 35 billion euros

- 11.5% for ICT with 8.1 billion euros

IT Service Companies Barometer: 5 Growth Levers to Continue Boosting the French Digital Sector

Beyond the cloud, which remains the most promising lever for the digital market in France, new emerging markets are small but with very strong growth, such as responsible digital technology and AI.

- The Cloud (platforms and services): a market of 39.4 billion euros with +14.2% growth expected in 2024

- Big Data: a market of 5.4 billion euros with +16.8% growth expected in 2024. Data collection and usage become essential to evolving business models, developing new services, and optimizing operations.

- Security: a market of 7 billion euros with +10.6% growth expected in 2024. The growth of investments and outsourcing is essential to prevent the increase in risks, regulations, and attacks.

- Artificial Intelligence: a market of 2.8 billion euros with +35.7% growth expected in 2024. The topic is not new, but new technologies are democratizing and accelerating it.

- Responsible Digital Technology: a market of 1.3 billion euros with +38% growth expected in 2024. An essential lever for the growth of companies and organizations in the sector.

Spearheaded by Véronique Torner, responsible digital technology is no longer an option but a necessity for companies and their clients.

According to the survey conducted by PAC for Numeum, in 2024, 78% of digital companies plan to intensify their actions related to responsible digital technology, mainly focusing on environmental aspects. Moreover, companies are increasingly required to demonstrate their actions in corporate social responsibility (CSR) during tenders.

Indeed, 80% of digital companies of all sizes respond to tenders with CSR criteria. Nearly 1 in 2 digital companies (46%) win projects that involve CSR topics.

Talents Remain the Key to Competitiveness

Faced with the slowdown in order book deployment, digital companies were more cautious about job creation in 2023.

In fact, 7,000 jobs were created last year compared to 47,000 jobs in 2022, which marked a record. It is important to note that jobs created in the digital sector are generally long-term: 90% are permanent contracts and 80% are executive positions.

Despite this slowdown, the digital sector remains under pressure, and the need for skills is still significant. The most sought-after skills include security, cloud, and data for IT service companies and ICT, and RD teams for software publishers. Additionally, experienced or senior profiles are the most demanded by companies.

Turnover remains structural due to an ultra-competitive market: 45% of employees who left their company in the first six months of this year went to clients and 43% to competitors.

Artificial Intelligence: A New Growth Engine for IT Service Companies

As the rise of generative AI generates strong enthusiasm, the survey reveals a strong interest from digital companies in this new era, which they see as a source of opportunities for improvement (70%) and business (50%). Only 9% of companies in the sector see it as a significant threat to employment. At the same time, 85% of digital companies have already integrated generative AI into their internal processes in 2023 or plan to do so in 2024 and beyond.

The adoption of AI in digital companies varies depending on the professions and processes. While some areas such as software development, marketing, and software testing are more inclined to use AI, other functions like HR, legal, and finance explore their potential more moderately.

Companies that can identify relevant use cases for AI and effectively integrate it into their processes will be best positioned to take advantage of this revolutionary technology.

“Despite a slowdown, digital growth remains remarkable. Our companies’ investments in corporate social responsibility (CSR) are wisely directed, and strengthening the development of our talents in high-value and innovative technologies is a priority. Artificial intelligence and responsible digital technology hold immense potential to make France a great digital nation. Numeum and our members remain vigilant about the post-dissolution context, which could have repercussions on our companies’ activities, particularly regarding public markets. “

Véronique Torner

President of Numeum

IT Service Companies and ICT Barometer: The End of the Post-Covid Years

For IT service companies and ICT, the situation is relatively similar. Charles Mauclair, a board member in charge of the IT service company and ICT sector, explains: ” We are seeing a slowdown in growth activities. This growth is expected to be 2.1% in 2024 (for a turnover of 34.9 billion euros) compared to 4 to 5% in previous years. There is therefore a clear correction compared to the growth achieved during the post-Covid years. However, there is a difference in growth depending on the positioning of IT service companies. “

In summary, activity is slowly picking up in the first half of 2024. The main obstacles to growth remain the economic situation of clients, the lack of commercial opportunities, and the lack of resources. In detail, the industry (31%) and the public sector drive the growth of IT service companies.

On the other hand, IT service companies and ICT have adapted well to the situation, particularly in terms of pricing. 25% of them have not passed on inflation or salary increases to their prices.